There are many good choices when it comes to sending money from abroad to Philippines. The best to use is Wise, because it has the lowest fees.

You can open a wise account and send directly to their Philippines bank account, it is very fast and fees are very small, exchange rate will be in your advantage.

This guide covers everything you need to know about Wise money transfers in the Philippines, including fees, and how to send money.

What is Wise?

Wise launched in the Philippines in May 2024. It offers a Wise account and a prepaid debit card, as well as easy ways of receiving money in PHP and other currencies from others.

Wise is a financial technology company and licensed in the Philippines by the Bangko Sentral ng Pilipinas (BSP), Wise is also overseen by a range of other global bodies, making it a safe place to keep and send your money.

How to open a Wise account

There’s no fee to open a Wise personal account.

Signing up is fast and easy. You initially just need to input your personal details and email and your account will be created in minutes.

Here’s how to open a Wise Account:

- Download the Wise app or open the Wise desktop site

- Tap register

- Create an account using your email, Apple ID, Google ID or Facebook details

- Add your personal information, following the onscreen prompts

- Get verified

- Top up your account, order an international debit card or set up your first transfer

- You’re ready to go

To get verified you need to upload photos of your ID and a selfie. If your nationality is Filipino, you might choose to use:

- Philippines National ID (PhilID)

- Passport

- Driving licence

- UMID

How to send money to Philippines

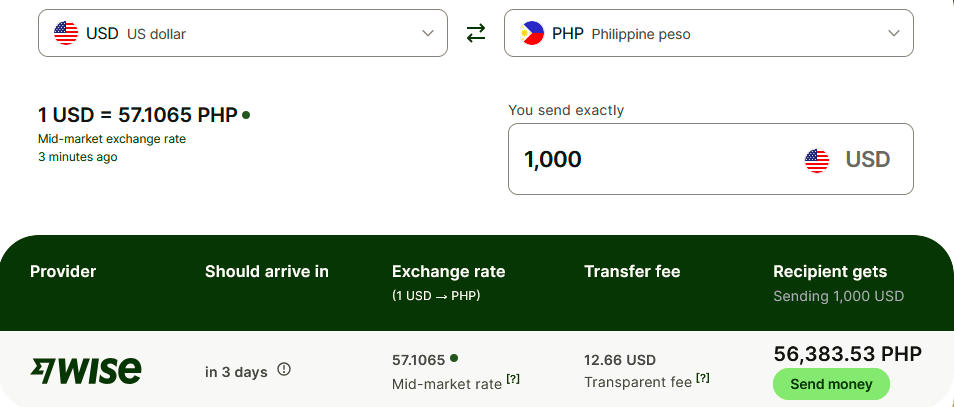

Wise uses the mid-market exchange rate for sending money and combines that with a low, upfront fee, and you get international transfers that are cheap, fair and transparent.

For example, you want to send money from abroad in USD to Philippine Peso:

- Enter amount to send in USD. Pay in USD with your debit card or credit card, or send the money from your online banking into Wise’s local bank account.

- Choose recipient in Philippines. Select who you want to send money to and which pay-out method to use.

- Send USD, receive PHP. The recipient gets money in PHP directly from Wise’s local bank account. Your money never crosses borders.

How much does it cost

How much a transfer costs depends on three things — the amount you’re sending, how you pay, and the exchange rate.

Just send it directly from your USD account to your local PHP bank acocunt, Wise will then convert it to PHP, around 1% charge for everything.

Summary

Wise is an established financial technology company that offers secure international transfers and multi-currency prepaid cards at competitive rates. Customers can send money to over 160 countries in more than 40 currencies.

Although exchange rates and transaction charges are transparent, it may be possible to find cheaper deals elsewhere, depending on your specific transfer.

Latest comments